The Investments section of the Colombian journal PUBLICATIONS SEMANA pointed out a new reality of global economy.

““Today, emerging markets draw the most attention of investors. Financial and macroeconomics conditions of many emerging markets are more stable and healthier than the conditions in some developed countries.””

In this article “Vale la pena inverter en mercados emergentes?” (Is it profitable to invest in emerging markets?) also six elements that make emerging markets the best option for investor in 2015 are identified.

Emerging markets have Governments with more balanced budgets, higher sales potential, have projections of economic growth, their markets have plenty of room to grow and their currencies are increasing in value.

In few words this pillars refer that the balance between debt and economic growth in emerging markets is two times better than markets of developed countries, they have millions of consumers, their economies will continue growing because of the increase of value on agricultural products and precious metals in the following years, their markets have plenty of room to grow and their population is younger on average than in developed countries, and the currency appreciation makes investors gain double profit.

J.P. Morgan Asset Management agrees that growing rates are in emerging markets than markets of developed countries and that they are the main beneficiaries of the increase on value of raw materials as oil and precious metals. Also, the asset manager adds as a reason to invest in emerging markets that these are less related to developed markets what makes the a tool of diversification of risk.

Moreover, which are the so-called emerging markets? According to Bloomberg’s Visual Data the Best Frontier Markets in 2014 were Qatar in first place with a total score of 73.36, followed by United Arab Emirates and Saudi Arabia with totaled scores of 72.46 and 72.26 respectively. The Rank continues with Estonia (4th), Bahrain (5th), Slovakia (6th), Lithuania (7th), Bulgaria (8th), Romania (9th) and Kazakhstan (10th).

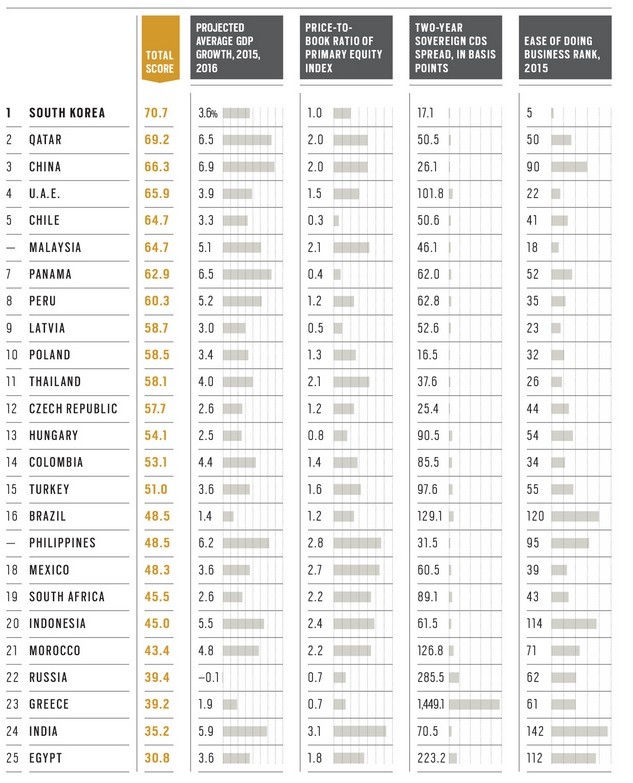

In Bloomberg Markets’ fourth annual ranking of the most-promising emerging nations in which to invest in 2015, published in both English and Spanish speaking journals as Bloomberg Business news and El Confidencial, South Korea has the first place, with Qatar No. 2, China No. 3, United Arab Emirates No. 4, Chile No. 5, Malaysia No. 6, Panama No. 7, Peru No. 8, Latvia No. 9, Poland No. 10, Thailand No. 11, Czech Republic No. 12, Hungary No. 13, Colombia No. 14, Turkey No. 15 and Brazil No. 16.

In order to make this rank 19 elements as the GDP growth and the ease of doing business were taken into account. Not surprisingly, most of these countries are located in Asia or South America. Agustino Fontevecchia in his article on Forbes Forget China, Look to Latin America said,

““… while China draws the most attention,

tame inflation and growing domestic

demand in Latin America makes

investments in Brazil, Chile and

elsewhere just as likely to deliver

strong returns as their Asian

counterparts”.”

He points out that Nick Chamie, chief emerging markets strategist at Royal Bank of Canada, said that while “Latin America seems to be making strong progress … The story in Asia is well understood but inflation threats.”.

See also:

//www.jpmorganassetmanagement.es/es/showpage.aspx?pageID=71

//www.forbes.com/2010/12/28/latin-america-economic-growth-emerging-markets-brazil.html